GRC Analyst Roles and Responsibilities: Career Path, Skills, Salary & Interview Guide

GRC Analyst Roles and Responsibilities: Career Path, Skills, Salary & Interview Guide

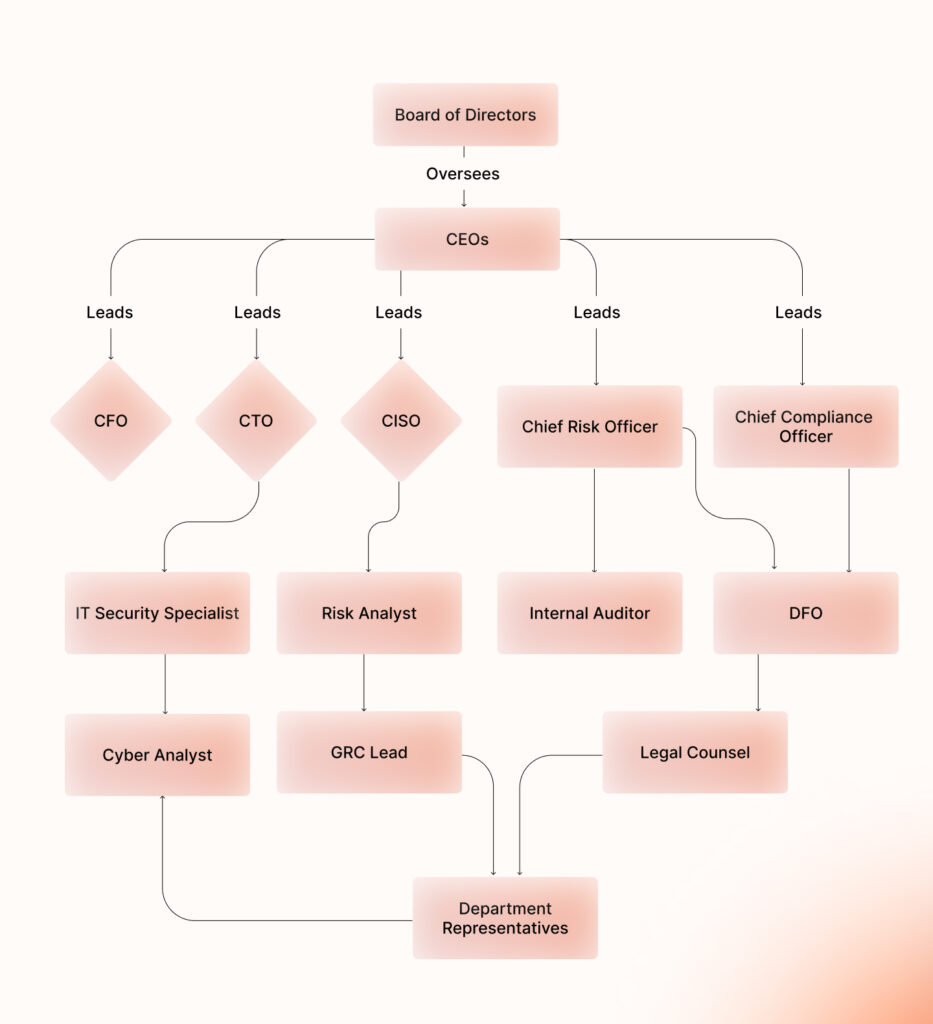

Today, organizations face increasing scrutiny from regulators, clients, and stakeholders. Governance, Risk, and Compliance (GRC) analysts are central to scaling through this complexity. These professionals ensure that companies operate ethically, adhere to regulations, and minimize operational and cybersecurity risks. In essence, GRC analysts act as the guardians of corporate integrity and stability.

A GRC analyst’s role spans multiple domains. They are responsible for assessing risks across processes, systems, and operations, ensuring compliance with standards such as GDPR, HIPAA, SOX, and ISO frameworks. Beyond monitoring regulations, GRC analysts develop policies, implement controls, and coordinate across departments, including IT, legal, finance, and operations, to align organizational practices with compliance requirements.

GRC analysts are also increasingly integral to cybersecurity efforts. Many organizations now require professionals who can integrate information security measures into governance and compliance strategies, making information security GRC roles and responsibilities a key component of the job. This involves evaluating threats, implementing preventive measures, and ensuring that incident response plans meet regulatory standards.

Entry into the field often begins with junior GRC analyst roles and responsibilities, which include supporting audits, monitoring compliance programs, and assisting senior analysts in risk assessments. These roles provide practical exposure to GRC processes, helping aspirants develop the analytical, technical, and communication skills necessary to progress into senior positions.

Industries with high regulatory demands, finance, healthcare, and technology, tend to offer the most opportunities for GRC analyst jobs, reflecting the growing reliance on professionals who can combine regulatory knowledge, risk management expertise, and operational insight.

GRC analysts are not just policy enforcers; they are strategic partners who guide organizations in managing uncertainty, safeguarding assets, and promoting a culture of compliance and ethical behavior. Their work ensures that companies are not only audit-ready but resilient in the face of emerging risks and evolving regulations.

Start a Life-Changing Career in Cybersecurity Today

GRC Analyst Career Path

Becoming a GRC analyst involves a blend of education, practical experience, and continuous professional development. The GRC analyst career path typically begins with foundational roles that allow aspiring professionals to gain hands-on exposure to compliance, risk management, and governance processes.

Entry-Level Opportunities

Most GRC analysts start their careers in positions such as Compliance Assistant, Risk Associate, or Junior Analyst. These roles often encompass responsibilities like monitoring regulatory adherence, assisting in risk assessments, preparing documentation, and supporting audits. For those pursuing junior GRC analyst roles and responsibilities, these positions provide critical insight into how organizations implement compliance frameworks and manage risk.

Entry-level experience also helps build proficiency in GRC tools such as ServiceNow, MetricStream, and Archer, giving professionals a practical understanding of workflow automation, risk tracking, and policy management.

Progression to Mid-Level Roles

After gaining 2–3 years of experience, GRC professionals often transition into mid-level roles such as GRC Analyst or Information Security Analyst. At this stage, responsibilities expand to include conducting in-depth risk assessments, developing policies, and advising departments on compliance best practices. Integration with cybersecurity teams becomes crucial, especially for organizations seeking robust information security governance.

Certifications such as CISA, CRISC, or CISSP can significantly enhance career prospects at this stage, demonstrating expertise in risk management, compliance auditing, and governance strategy.

Senior-Level Advancement

Senior GRC roles, including Senior GRC Analyst, GRC Manager, or Director of Governance, Risk, and Compliance, require comprehensive oversight of an organization’s compliance and risk management programs. Professionals at this level are responsible for shaping governance frameworks, ensuring regulatory alignment across departments, and advising executive leadership on strategic risk mitigation.

These roles often demand a combination of advanced certifications, proven track records in risk management, and exceptional analytical and communication skills. As such, the journey from entry-level to senior positions reflects both technical proficiency and the ability to influence organizational culture and decision-making.

Key Factors for Career Growth

Several factors can accelerate advancement along the GRC analyst career path:

- Continuous learning: Staying updated on emerging regulations, frameworks, and industry trends is essential.

- Certifications: Credentials like ISO/IEC 27001, CISSP, CISA, and CRISC demonstrate professional expertise.

- Cross-functional collaboration: Experience working across IT, legal, finance, and operations ensures a holistic understanding of organizational risk.

- Demonstrated results: Successful project implementation, risk mitigation, and process improvement initiatives increase visibility and credibility.

The career path of a GRC analyst is both challenging and rewarding. Professionals who combine technical knowledge with strategic insight, strong interpersonal skills, and a commitment to ethical practices are well-positioned to advance in this high-demand field.

RELATED: How to Become a GRC Analyst?

GRC Analyst Roles and Responsibilities

At the core of the profession, GRC analyst roles and responsibilities encompass a wide range of functions that help organizations operate efficiently while maintaining compliance and mitigating risks. These responsibilities extend beyond simple oversight; they involve strategic planning, cross-functional collaboration, and proactive risk management.

Risk Assessment and Management

A primary duty of GRC analysts is to identify and evaluate potential risks across processes, systems, and operations. Analysts conduct thorough risk assessments to measure the likelihood and impact of each threat, from cybersecurity vulnerabilities to operational inefficiencies. Using these insights, they develop mitigation strategies and monitor their implementation, ensuring that risks are minimized without impeding business objectives.

Regulatory Compliance

Compliance remains a central focus for GRC professionals. Analysts must stay current with evolving regulations such as GDPR, HIPAA, SOX, and industry-specific standards. They design and implement compliance programs, monitor adherence, and advise departments on regulatory best practices. Ensuring that policies and procedures align with these standards reduces the risk of fines, legal exposure, and reputational damage.

Policy Development and Implementation

GRC analysts are responsible for developing, updating, and enforcing organizational policies. This includes creating standard operating procedures, drafting compliance guidelines, and establishing internal controls. Effective policies help maintain consistency, guide employee behavior, and ensure that governance frameworks are applied across all departments.

Monitoring, Auditing, and Reporting

Continuous monitoring and auditing are essential to detect deviations from established policies or regulatory requirements. GRC analysts prepare detailed audit reports, document compliance findings, and recommend improvements. Regular audits not only maintain regulatory alignment but also strengthen the organization’s resilience against internal and external risks.

Incident Response and Data Protection

GRC analysts play a pivotal role when incidents occur, such as data breaches or compliance violations. They coordinate with relevant teams to contain incidents, assess impact, document findings, and implement corrective measures. Overseeing information security GRC roles and responsibilities, analysts ensure that sensitive data is protected, systems are secure, and regulatory reporting obligations are fulfilled.

Training and Cross-Functional Collaboration

Promoting a culture of compliance requires communication and education. GRC analysts conduct training programs to educate employees on risk management practices, compliance standards, and ethical behavior. They also collaborate closely with legal, IT, finance, and operational teams to integrate governance, risk, and compliance principles into daily workflows.

By fulfilling these responsibilities, GRC analysts act as the bridge between regulatory requirements and organizational operations. Their work safeguards corporate integrity, minimizes financial and legal risks, and ensures that the company can operate confidently in complex regulatory environments.

GRC Analyst Skills

To succeed as a GRC analyst, professionals must combine technical expertise with strong interpersonal and analytical capabilities. Understanding the GRC Analyst skills required is essential for both career development and effective performance in the role. These skills can be grouped into three categories: technical, analytical, and soft skills.

Technical Skills

- Regulatory Framework Knowledge: GRC analysts must be well-versed in standards and regulations relevant to their industry, such as GDPR, HIPAA, SOX, ISO 27001, and PCI DSS.

- Compliance Program Management: Ability to design, implement, and monitor compliance initiatives is fundamental. This includes developing policies, documenting procedures, and ensuring adherence across departments.

- Risk Management Expertise: Understanding risk assessment methodologies, mitigation strategies, and control frameworks is critical. Analysts must evaluate potential threats, quantify risk, and recommend actionable solutions.

- Information Security Awareness: Modern GRC roles often overlap with cybersecurity. Analysts should be familiar with security protocols, data protection strategies, and incident response processes. Knowledge of information security GRC roles and responsibilities enhances their ability to safeguard organizational assets.

- Tool Proficiency: Familiarity with GRC software platforms such as ServiceNow, Archer, MetricStream, RiskLens, and OneTrust enables efficient monitoring, reporting, and risk management.

Analytical and Strategic Skills

- Analytical Thinking: GRC analysts must dissect complex processes, interpret regulatory requirements, and identify potential gaps or vulnerabilities.

- Problem-Solving: They must develop practical solutions for compliance issues, operational risks, and cybersecurity challenges.

- Data Interpretation: The ability to analyze large datasets, audit results, and risk assessments is crucial for informed decision-making.

Soft Skills

- Communication: Translating complex regulations and risk assessments into understandable insights for non-technical stakeholders is essential.

- Collaboration: GRC analysts work across legal, IT, finance, and operational teams, making teamwork and cross-department coordination vital.

- Ethical Integrity: Maintaining transparency and enforcing compliance standards require a strong sense of ethics and professional responsibility.

- Adaptability: Regulatory landscapes evolve rapidly; analysts must stay current and adjust strategies as needed.

These skills collectively enable GRC analysts to navigate complex regulatory environments, support organizational governance, and contribute to strategic decision-making. Mastery of technical competencies, coupled with strong analytical and interpersonal abilities, positions professionals for success in both entry-level and senior GRC roles.

ALSO READ: What Are Governance Risk and Compliance GRC Certifications?

GRC Analyst Salary

If you’re considering a career as a GRC analyst, compensation is one of the biggest draws, especially when you factor experience, specialization, and industry. That’s why understanding typical pay ranges and what influences them is essential.

Typical Salary Range (U.S.)

- According to recent U.S.-based data, the typical base salary for a Governance, Risk, and Compliance analyst is around US$100,947 per year.

- Most in the “middle” range (25th–75th percentile) earn between ≈ US$94,670 and US$108,766.

- Entry-level roles often start lower, roughly US$88,954 per year (10th percentile) in some cases.

- On average, another source estimates a typical GRC analyst salary around US$112,269/year, with many reporting between US$87,875 and US$144,994 depending on seniority and employer.

Because of variation across sources and job markets, reported ranges differ somewhat, but most major surveys cluster around the US$90k–115k base pay for early-to-mid careers.

What Drives Salary Variation

Several factors influence how much a GRC analyst earns:

- Experience & Seniority: Naturally, salary increases as you move from junior analyst to mid or senior roles.

- Specialization / Role Scope: Analysts working in information security GRC (adding cybersecurity, audits, regulatory compliance) often command higher salaries.

- Industry & Demand: Sectors with heavy regulation, finance, healthcare, tech often pay more due to higher compliance demands.

- Location / Cost of Living: Geographic location in the U.S. affects pay significantly; markets with high demand or high living costs tend to offer higher compensation.

- Certifications & Skills: Possessing recognized certifications (e.g., audit, compliance, cybersecurity, risk frameworks) and proven ability with tools/frameworks can tilt salary upward.

What This Means for Candidates, and You

If you’re entering the field, expect something in the US$90,000–105,000 per year bracket for a junior to mid-level role, especially in sectors like technology or finance.

If you gain experience, specialize in information‑security compliance, and perhaps move into a mid-to-senior role, your potential climbs substantially. Analysts with broader scope (compliance + cybersecurity + policy oversight) often hit $100K+ easily, and top positions (especially in high‑demand sectors) may exceed $140K+ annually.

For professionals targeting remote or high-regulation industries, especially in finance, healthcare, or global tech companies, this makes the role a lucrative and stable option.

Notes / What influences variation:

- Pay varies significantly based on experience, certifications, and specialization (e.g. information‑security compliance, audit-heavy roles).

- Industry and sector matter; heavily regulated fields like finance, healthcare, and technology often pay more.

- Location: Salaries are often higher in metropolitan areas or regions with high cost of living.

- Scope of responsibilities: Broader roles, combining compliance, cybersecurity governance, risk management, tend toward higher pay.

GRC Analyst: Salary Percentile Breakdown (U.S.)

A few notes:

- The 25th–75th spread shows there’s a significant range depending on experience, role scope, location, and industry.

- The “90th percentile / high-end” range often corresponds to specialized roles, like those involving information security, GRC, high‑risk industries, or senior-level responsibilities.

- These bands generally reflect base annual salary only, total compensation might be higher if bonuses, stock options, or other incentives are included.

Global & Remote Compensation: What to Expect Outside the U.S.

Key Considerations & What Affects Global Pay

- Where the employer is based matters a lot, remote roles tied to U.S. or Canadian companies often pay in USD/CAD and reflect those economies; this tends to be more lucrative for professionals living in countries with weaker currencies or lower cost-of-living.

- Seniority and specialization shift the numbers dramatically. Roles blending traditional GRC + cybersecurity + compliance (e.g., “security‑GRC analyst,” “remote compliance analyst,” etc.) tend to sit at the higher end of pay scales.

- Local market and regulation context influences base pay. In countries like the UK or Canada, salaries account for local cost-of-living, taxation, and industry demand, which tend to yield lower base pay than U.S. counterparts but are often stable and with good benefits.

- Currency exchange & purchasing power matter for diaspora professionals. For example, a U.S.-paid remote salary can stretch much further when converted to weaker currencies abroad, offering a financial advantage for immigrants or remote workers living outside the U.S.

SEE MORE: Cybersecurity Threats for LLM-Based Chatbots: 2026 Update for Professionals

Global & Remote Pay: What Recent Data Shows for GRC Analysts

What This Means for Global & Diaspora Professionals

- If you land a remote GRC or Security‑GRC job with a U.S. employer, you may benefit from higher U.S.‑level pay while living outside the U.S., which could translate to better purchasing power depending on exchange rates and cost of living.

- For Canada or UK-based roles, salaries are noticeably lower (in local currency), but may still be competitive depending on living costs, and for many diaspora professionals, may still represent a good income compared to local standards.

- Specialization matters: roles that mix cybersecurity, regulatory compliance, and governance generally pay more than “classic” compliance‑only or audit‑only GRC roles.

- Senior-level roles or roles in high‑regulation industries (finance, healthcare, tech) tend to sit toward the upper end of each region’s pay range.

- Currency, local taxes, cost of living, and benefit packages (bonuses, stock, etc.) should be considered; base salary alone doesn’t tell the whole story for global workers.

GRC Analyst Certifications & Tools

To stand out and perform effectively as a GRC analyst, credentials and the right toolset make a big difference. Below is a rundown of the most respected certifications in the field, plus the leading software platforms that GRC analysts use to manage compliance, risk, audits, and governance.

Top Certifications for GRC Analysts

These certifications are widely recognized in the governance, risk, compliance, and cybersecurity community. They validate your skills, improve credibility, and often influence hiring decisions.

SEE: Vendor Risk Management (VRM) in 2025

Leading GRC Tools & Software Platforms

In modern organizations, manual spreadsheets and isolated compliance checks are no longer enough. GRC analysts more and more rely on purpose-built GRC platforms to manage risk, compliance, audits, policy, and governance. Below are some of the most respected tools in 2025:

| Tool / Platform | Core Strengths / Use Cases |

| ServiceNow GRC | Integrates risk, compliance, audit, third‑party risk, privacy, and business continuity under one platform. Great for organizations that already use ServiceNow for ITSM/IT operations. |

| RSA Archer | Modular and highly customizable, supports enterprise risk management, audit, compliance, and policy management. Good for large organizations with complex regulatory requirements. |

| MetricStream | Known for flexibility and scalability, handles risk, compliance, audit, policy workflows, and helps unify governance across departments. Frequently used in regulated sectors. |

| LogicGate Risk Cloud | Cloud‑based, automation‑friendly GRC platform; good for medium‑size or rapidly scaling organizations needing custom compliance workflows, vendor risk, or internal audit capabilities. |

| AuditBoard | Strong in audit management, internal controls, SOX compliance, useful for firms needing systematic audit and compliance tracking. |

Why Tools Are Important:

- They automate and streamline complex processes, risk assessments, control tracking, audit readiness, compliance reporting, and policy management, reducing manual overhead.

- They provide centralized dashboards, real‑time risk visibility, audit trails, and integration with IT/security systems, which is critical for organizations under strict regulatory oversight.

- For an aspirant GRC analyst or someone building a GRC team, familiarity with these tools is often a requirement or a strong advantage in job listings.

What This Means for You (Especially Coming From a Cybersecurity/EdTech Background)

- If you’re transitioning into GRC (or coaching others to), aiming for certifications like CRISC, CISA, or GRCP provides a recognized foundation.

- If you already have cybersecurity knowledge (from your background), pairing that with a GRC‑focused certification (e.g., CISM or ISO 27001 related) can position you well for Information Security GRC roles, a high-demand intersection.

- When targeting companies (especially larger firms or regulated industries), proficiency in standard GRC platforms (ServiceNow, Archer, MetricStream, etc.) is a strong value-add and could set you apart from other candidates.

- For remote or international audiences (diaspora, global clients), GRC certifications and familiarity with widely-used GRC tools make credentials more portable, attractive to foreign employers or remote hiring managers.

Preparing for a GRC Analyst Interview

Landing a GRC analyst position requires more than just technical knowledge — interview preparation is critical to demonstrate your expertise in GRC analyst roles and responsibilities, your familiarity with industry frameworks, and your ability to contribute strategically. Understanding common questions, structuring responses effectively, and highlighting relevant skills can make the difference in a competitive market.

Common Interview Questions

Interviewers typically evaluate both technical competence and practical experience. Here are key areas and sample questions:

1. Risk Assessment & Management

- “Can you describe a time when you identified a significant risk within an organization and how you addressed it?”

- “How do you prioritize risks in a risk management framework?”

2. Regulatory Compliance

- “How do you stay updated with the latest regulatory changes affecting your industry?”

- “Can you provide an example of how you ensured compliance with a specific regulation?”

3. Policy Development & Implementation

- “What steps do you take to develop and implement new policies within an organization?”

- “How do you ensure that policies remain relevant and compliant with regulatory standards?”

4. Monitoring, Auditing, & Reporting

- “Describe your experience with conducting internal audits. What challenges did you face, and how did you overcome them?”

- “How do you monitor the effectiveness of compliance programs?”

5. Incident Response

- “Walk us through your process for handling a data breach or compliance violation.”

- “What are the key components of an effective incident response plan?”

6. Cross-Functional Collaboration

- “How do you work with other departments to integrate GRC considerations into daily operations?”

- “Can you share an example of successful collaboration with another team on a compliance or risk project?”

Interview Preparation Tips

1. Research the Company

- Understand the organization’s industry, regulatory environment, and current GRC challenges.

- Review recent audits, compliance initiatives, or incidents reported in the news to show awareness and proactivity.

2. Review Relevant Frameworks and Standards

- Be prepared to discuss key frameworks: ISO 27001, NIST, GDPR, SOX, and others.

- Explain how you have applied these frameworks in past projects or how you would implement them in hypothetical scenarios.

3. Showcase Tool Proficiency

- Highlight experience with GRC tools such as ServiceNow, Archer, MetricStream, or OneTrust.

- Provide examples of dashboards, reports, or processes you have managed through these platforms.

4. Use Real-World Examples

- Structure answers using the STAR method (Situation, Task, Action, Result) to illustrate problem-solving, initiative, and impact.

- Emphasize measurable results: reductions in compliance violations, successful audit outcomes, or process improvements.

5. Highlight Soft Skills

- Communication, collaboration, analytical thinking, and ethical integrity are crucial.

- Demonstrate empathy and understanding when discussing how you implement compliance measures without disrupting operations.

6. Prepare Insightful Questions

- Ask about the company’s biggest GRC challenges, upcoming audits, or regulatory priorities.

- Questions like: “How does your team integrate cybersecurity and compliance frameworks?” or “Which frameworks or certifications does the company value most for career growth?” show strategic thinking.

A successful GRC analyst interview balances technical mastery, practical experience, and interpersonal skills. Demonstrating your understanding of risk, compliance, and governance, while showing how you apply these concepts using modern tools and frameworks, positions you as a candidate capable of delivering tangible value to the organization.

READ: Risk Analysis in Cyber Security: 2025 Complete Analysis

Challenges Faced by GRC Analysts

Working as a GRC analyst involves navigating a complex and evolving environment. Understanding the common challenges and how to address them is essential for career growth and effective organizational impact.

1. Regulatory Complexity

Regulations and compliance standards are constantly changing. GRC analysts must stay current with new laws, industry standards, and internal policies. Different sectors and geographic regions have unique compliance requirements, increasing the complexity of managing governance, risk, and compliance. Continuous education and certification help analysts remain effective in this dynamic landscape.

2. Data Management

GRC analysts handle large volumes of sensitive data, including compliance records, risk assessments, and audit reports. Ensuring data accuracy, organization, and accessibility is critical. Mistakes or oversights can result in compliance violations, operational risks, or audit failures. Using integrated GRC platforms like ServiceNow, Archer, and MetricStream can mitigate these challenges by centralizing and automating data workflows.

3. Integration of GRC Processes Across Departments

Many organizations operate with siloed systems for risk management, compliance, and audits. Integrating GRC processes across IT, finance, legal, and operational teams is often challenging. Analysts must coordinate effectively, ensure consistent application of policies, and manage change resistance to create a cohesive compliance environment.

4. Cultural Resistance

Employees and departments may perceive GRC requirements as bureaucratic or restrictive. Analysts must communicate the value of compliance, align GRC initiatives with business objectives, and foster a culture that prioritizes risk awareness and ethical behavior. Building relationships and demonstrating practical benefits are key strategies for overcoming resistance.

5. Risk Assessment Accuracy

Assessing risks accurately requires a deep understanding of organizational operations, industry context, and potential threats. Analysts must balance qualitative and quantitative data to prioritize risks effectively. Failure to identify or properly assess risks can compromise organizational security and regulatory compliance.

6. Emerging Risks and Technology Changes

New threats emerge rapidly due to technological advancements, industry shifts, and global events. GRC analysts must proactively identify and address these risks, including cybersecurity threats, supply chain vulnerabilities, and regulatory changes in new technologies like cloud computing or AI.

7. Resource Constraints

Implementing robust GRC programs requires time, personnel, and technology. Limited resources can restrict the analyst’s ability to monitor all areas effectively. Prioritizing critical risks and leveraging automation tools helps mitigate resource limitations.

8. Preparing for Audits and Assessments

GRC analysts are often responsible for preparing the organization for internal and external audits. This includes ensuring documentation is complete, policies are followed, and controls are effective. Attention to detail, proactive planning, and communication with multiple departments are essential to succeed in this area.

Challenges in GRC are complex but manageable with strategy, tools, and communication:

- Continuous education and certifications help manage regulatory complexity.

- Integrated GRC platforms improve data management and process consistency.

- Building a culture of compliance and demonstrating practical value reduces resistance.

- Strategic prioritization allows analysts to focus on high-risk areas when resources are limited.

By recognizing these challenges and proactively addressing them, GRC analysts can enhance their effectiveness, maintain organizational resilience, and advance in their careers.

Conclusion

The role of a GRC analyst is central to maintaining organizational integrity, minimizing risk, and ensuring regulatory compliance. From understanding GRC analyst roles and responsibilities to mastering critical tools, acquiring certifications, and navigating complex regulatory landscapes, these professionals serve as the backbone of governance, risk management, and compliance programs.

Aspiring GRC analysts can build a rewarding career by following a structured GRC analyst career path, developing key GRC analyst skills, preparing for interviews effectively, and continuously updating their knowledge through certifications and practical experience. Understanding salary expectations, industry demand, and the challenges inherent in the role helps candidates make informed career decisions and positions them for success in a high-demand field.

For professionals seeking growth in governance, risk, or compliance, particularly those interested in information security GRC roles and responsibilities, the opportunities are extensive. Whether entering as a junior analyst or advancing to senior positions, the field offers both financial reward and the ability to make a measurable impact on organizational performance.

FAQ

What is the difference between a GRC analyst and a compliance analyst?

A GRC analyst has a broader role than a compliance analyst. While a compliance analyst primarily ensures that an organization follows laws, regulations, and internal policies, a GRC analyst integrates governance, risk, and compliance across all business processes.

This includes evaluating risks, monitoring controls, managing audits, and advising management on operational and strategic decisions. Essentially, GRC analysts combine compliance with proactive risk management and organizational governance.

Can AI replace a GRC analyst?

Artificial intelligence can assist GRC analysts by automating routine tasks like monitoring compliance, flagging potential risks, generating reports, or analyzing large datasets.

However, AI cannot fully replace a GRC analyst because the role requires strategic judgment, ethical decision-making, cross-department collaboration, and interpretation of complex regulatory requirements, tasks that rely on human experience and insight. AI serves as a tool to augment their efficiency, not substitute their expertise.

Is GRC a stressful job?

GRC can be demanding due to regulatory complexity, the need for precision, and responsibility for mitigating operational and cybersecurity risks. Analysts often balance multiple stakeholders, tight deadlines, and evolving compliance requirements.

However, proper tools, frameworks, and a structured workflow can significantly reduce stress. Strong organizational skills, familiarity with GRC platforms, and continuous learning also help professionals manage the demands effectively.

What skills increase GRC analyst salary?

Several skills can positively influence earning potential for GRC analysts:

Certifications: CRISC, CISA, CISSP, ISO 27001, or industry-specific credentials.

Technical Expertise: Cybersecurity knowledge, risk management, and familiarity with frameworks like NIST or GDPR.

Tool Proficiency: ServiceNow, Archer, MetricStream, OneTrust, or similar GRC platforms.

Soft Skills: Communication, collaboration, and strategic thinking to integrate GRC insights across departments.

Experience & Specialization: Hands-on experience with audits, compliance programs, and risk mitigation in high-demand industries like finance, healthcare, and technology.