What Are Governance Risk and Compliance GRC Certifications?

What Are Governance Risk and Compliance GRC Certifications?

Governance, Risk, and Compliance GRC certifications are professional credentials designed to validate a practitioner’s ability to manage an organization’s governance policies, assess and mitigate risks, and ensure adherence to regulatory and ethical standards.

In an increasingly complex business environment, these certifications provide tangible proof that an individual has the knowledge, skills, and judgment required to protect an organization from operational, financial, and reputational risks.

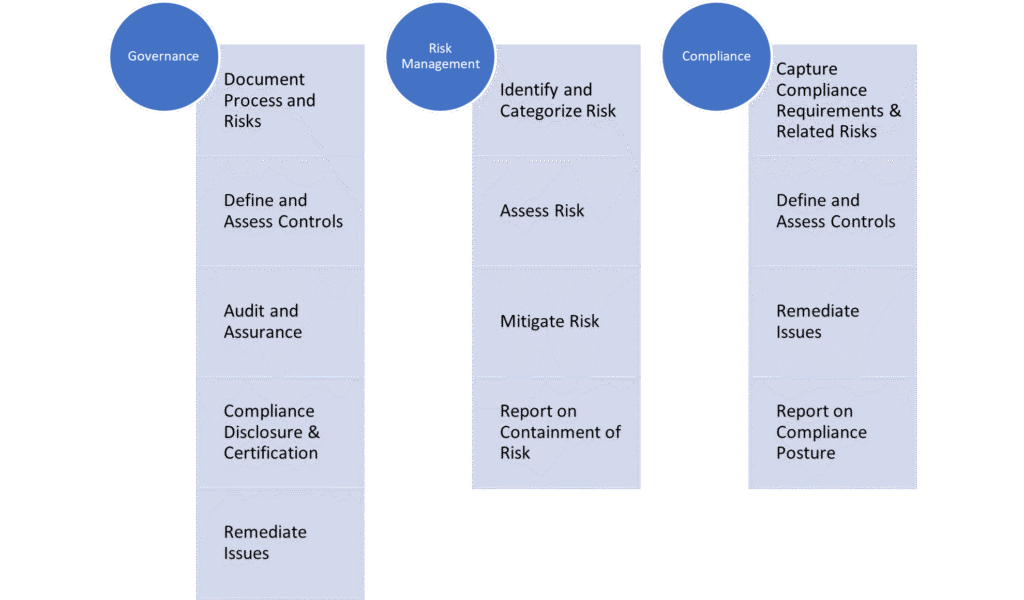

At their core, GRC certifications equip professionals to implement frameworks that align business objectives with regulatory requirements. This involves designing internal policies, monitoring compliance across multiple departments, and ensuring that risk management strategies are integrated into everyday operations.

Certified GRC professionals are expected to balance the organization’s goals with regulatory mandates, acting as a bridge between leadership, operational teams, and oversight bodies.

For organizations, employing staff with recognized GRC certifications offers measurable benefits. Certified professionals can proactively identify gaps in internal controls, reduce exposure to fines or sanctions, and enhance overall governance structures.

For individuals, these certifications signal expertise to current and potential employers, often translating into higher salaries, faster career progression, and eligibility for strategic roles such as risk manager, IT security analyst, or chief compliance officer.

Start a Life-Changing Career in Cybersecurity Today

Why GRC Certifications Are Essential

In today’s corporate environment, the importance of Governance, Risk, and Compliance (GRC) certifications cannot be overstated. High-profile corporate failures, including scandals like Enron and WorldCom, and subsequent regulations such as the Sarbanes-Oxley Act of 2002, highlighted the critical need for professionals capable of ensuring organizational compliance and risk management.

Companies now operate under intense scrutiny, with data protection laws, cybersecurity threats, and industry-specific regulations demanding vigilant oversight.

GRC certifications equip professionals to meet these challenges effectively. Certified practitioners are trained to identify and mitigate risks before they escalate, implement robust governance frameworks, and maintain compliance with legal and regulatory requirements. Their expertise ensures that organizations can navigate complex operational landscapes while protecting assets, data, and reputation.

For individuals, earning a GRC certification provides tangible career advantages. Certified professionals often enjoy higher earning potential, access to leadership opportunities, and recognition as trusted experts in their field. For employers, hiring staff with verified GRC competencies strengthens internal controls, reduces the likelihood of costly compliance violations, and enhances overall corporate governance.

Moreover, GRC certifications offer versatility. Whether in IT security, auditing, project management, or enterprise risk management, these credentials demonstrate a broad understanding of governance, risk, and compliance principles that can be applied across industries and geographies. This combination of professional credibility, organizational value, and career mobility underscores why GRC certifications remain essential for modern business operations.

Criteria for Selecting the Best GRC Certifications

Not all Governance, Risk, and Compliance (GRC) certifications are created equal. Choosing the right credential requires careful evaluation of several factors to ensure it aligns with your career goals, industry demands, and budget. Understanding these criteria helps professionals invest their time and resources wisely, maximizing both career growth and organizational impact.

1. Relevance to Industry Needs

A valuable GRC certification addresses current and emerging challenges in governance, risk management, and compliance. Professionals should prioritize certifications aligned with industry regulations, cybersecurity trends, and enterprise risk frameworks. Certifications that reflect the latest standards are more likely to be recognized by employers and applicable across multiple sectors.

2. Recognition and Credibility

The certifying body’s reputation is critical. Well-established organizations, such as ISACA, ISC2, OCEG, and the Compliance Certification Board (CCB), offer certifications widely respected by employers worldwide. Credible certifications enhance professional credibility, signaling to hiring managers and colleagues that the holder possesses validated expertise in GRC principles.

3. Coverage of Key GRC Domains

Effective certifications comprehensively cover governance, risk management, and compliance. This includes understanding regulatory requirements, developing risk mitigation strategies, implementing controls, and establishing ethical governance practices. Professionals should select certifications that ensure a balanced and practical understanding of all three domains.

4. Prerequisites and Eligibility Requirements

Some certifications require specific educational backgrounds or professional experience. Entry-level certifications may be open to all professionals, while advanced credentials often demand several years of relevant experience or prior certifications. Assessing prerequisites ensures that candidates can qualify without unnecessary delays or additional training.

5. Cost and Maintenance Fees

Certification costs vary widely, including initial exam fees, preparatory courses, and ongoing maintenance requirements such as continuing professional education (CPE) credits. Professionals should consider the total investment, balancing affordability with long-term career benefits.

6. Entry-Level vs. Advanced Certifications

Entry-level GRC certifications provide foundational knowledge, ideal for newcomers seeking to start their careers in compliance, risk management, or auditing. Advanced certifications target experienced professionals aiming for leadership roles or specialized expertise. Understanding your career stage helps in choosing the right certification path.

Selecting the best GRC certification involves aligning professional goals with industry expectations, certification credibility, and practical requirements. By carefully considering these criteria, professionals can make informed decisions that strengthen both their skillset and career trajectory.

RELATED: How to Become a GRC Analyst?

The Top 6 Governance, Risk, and Compliance (GRC) Certifications

For professionals seeking to excel in governance, risk management, and compliance, certain certifications stand out for their industry recognition, credibility, and practical value. The following six certifications are widely regarded as essential for IT professionals, auditors, risk managers, and compliance officers looking to advance their careers.

1. Certified Compliance & Ethics Professional (CCEP)

Provider: Compliance Certification Board (CCB)

Focus Areas: Compliance standards, policies and procedures, auditing, monitoring, and ethics program administration

Eligibility: Minimum one year of compliance experience or 1,500 hours of direct compliance duties

Exam & Maintenance: Multiple-choice exam; 20 CCB-approved continuing education units required; fees $350–$450; renewal $125–$245

Suitable For: Compliance officers, ethics professionals

The CCEP certification validates a professional’s ability to navigate complex regulatory environments and implement effective compliance programs. It equips individuals to oversee corporate ethics initiatives, conduct audits, and ensure adherence to legal requirements, making it a highly respected credential in both private and public sectors.

2. Certified Governance, Risk and Compliance (CGRC)

Provider: ISC2

Focus Areas: Information security risk management, authorization of information systems, security, and privacy controls

Eligibility: Minimum two years of relevant work experience in GRC domains

Exam & Maintenance: Multiple-choice exam; 60 CPE credits over three years; annual maintenance fee $135; exam fee $599

Suitable For: IT security analysts, risk managers

The CGRC certification focuses on integrating governance, risk management, and compliance into enterprise IT operations. Professionals learn to implement controls, evaluate risks, and maintain regulatory compliance, making this credential ideal for IT security and risk professionals who need to bridge technical and governance functions.

3. Certified in Risk and Information Systems Control (CRISC)

Provider: ISACA

Focus Areas: IT risk identification, risk response, mitigation strategies, control monitoring

Eligibility: Minimum three years of cumulative experience in IT risk and information systems

Exam & Maintenance: Multiple-choice exam; exam fees $575–$760

Suitable For: IT professionals managing risk and information systems controls

CRISC certifies professionals responsible for enterprise risk management, emphasizing IT controls and risk mitigation strategies. The credential is particularly valued by organizations seeking experts capable of aligning IT risk management with business objectives while ensuring compliance.

4. Certification in Risk Management Assurance (CRMA)

Provider: Institute of Internal Auditors (IIA)

Focus Areas: Risk management assurance, governance, quality assurance, control self-assessment

Eligibility: CIA certification; 3–4 year post-secondary degree; minimum two years of auditing or control-related experience

Exam & Maintenance: Multiple-choice exam; fees $465–$610; application fee $100–$220

Suitable For: Internal auditors, risk management professionals

CRMA holders are recognized as trusted advisors to senior management and audit committees. This certification demonstrates expertise in evaluating risk processes, implementing governance controls, and ensuring organizational accountability.

5. Certified in the Governance of Enterprise IT (CGEIT)

Provider: ISACA

Focus Areas: Enterprise IT governance, strategic management, risk optimization, resource allocation

Eligibility: Minimum five years of IT enterprise governance experience, including one year implementing governance frameworks

Exam & Maintenance: Multiple-choice exam; fees $525–$760

Suitable For: IT managers, enterprise governance advisors

CGEIT equips professionals to enhance enterprise value through effective governance of IT. It emphasizes strategic alignment, resource optimization, and risk management, making it suitable for senior IT leaders and governance advisors.

6. Certified Information Security Manager (CISM)

Provider: ISACA

Focus Areas: Information security governance, risk management, incident management, security programs

Eligibility: Minimum five years of information security management experience

Exam & Maintenance: Multiple-choice exam; fees $575–$760

Suitable For: Information security managers, IT directors

CISM validates expertise in managing and governing enterprise information security programs. Professionals with this certification are adept at assessing security risks, developing governance policies, and responding proactively to security incidents, essential skills in today’s cybersecurity-driven environment.

READ MORE: IoT vs Cybersecurity: 2026 Careers, Challenges, and Certifications

Entry-Level GRC Certifications

For professionals new to the field of governance, risk, and compliance, entry-level GRC certifications provide a solid foundation. These credentials are designed to equip beginners with the essential knowledge, terminology, and practical skills needed to start a career in compliance, risk management, auditing, or IT governance. Earning an entry-level certification not only validates your understanding but also positions you for more advanced GRC credentials and career growth.

Why Entry-Level Certifications Matter

Entry-level certifications allow newcomers to:

- Build a Strong Foundation: Understand core GRC principles, risk frameworks, and compliance requirements.

- Secure Career Entry: Qualify for entry-level roles such as compliance analyst, junior risk manager, or audit associate.

- Boost Confidence and Credibility: Demonstrate knowledge to employers and colleagues, establishing professional credibility early in your career.

Recommended Entry-Level GRC Certifications

- GRC Professional (GRCP)

Provider: OCEG

Focus Areas: Fundamental GRC principles, risk management, performance management

Eligibility: Open to all professionals; no specific education or experience required

Exam & Maintenance: 100-question open-book exam; fees $499 (All-Access Pass includes study materials)

Suitable For: Entry-level GRC professionals seeking broad industry applicability

- Certified Compliance & Ethics Professional (CCEP)

Provider: Compliance Certification Board (CCB)

Focus Areas: Compliance standards, policies, auditing, and ethics programs

Eligibility: One year of compliance experience or 1,500 hours of direct compliance duties

Exam & Maintenance: Multiple-choice exam; fees $350–$450; renewal $125–$245

Suitable For: Beginners in compliance, ethics, and regulatory roles

Benefits of Entry-Level GRC Certifications

- Career Launchpad: Entry-level credentials open doors to internships and junior positions.

- Pathway to Advanced Certifications: They prepare candidates for higher-level GRC certifications such as CGRC, CRISC, or CISM.

- Accessible Learning: Many entry-level certifications offer flexible online courses, making it easier to study alongside full-time employment.

By starting with entry-level certifications, professionals can establish credibility, gain practical knowledge, and position themselves strategically for long-term success in governance, risk, and compliance roles.

SEE ALSO: GRC Analyst vs SOC Analyst: Everything You Need To Know

Free and Online GRC Certification Options

While many Governance, Risk, and Compliance (GRC) certifications involve fees, there are several free and online options that provide a foundational understanding of GRC principles. These accessible programs are particularly valuable for newcomers, students, or professionals exploring the field before investing in advanced certifications.

1. OCEG GRC Fundamentals Course

OCEG offers a free online course that introduces the basic principles of GRC, including governance frameworks, risk assessment methodologies, and compliance strategies. This course is an excellent starting point for anyone seeking to understand how GRC operates within organizations. It also prepares learners for the GRC Professional (GRCP) certification, bridging foundational knowledge with a recognized credential.

Key Features:

- Self-paced online modules

- Interactive lessons with real-world examples

- Covers governance, risk, and compliance basics

- Certificate of completion available

2. MOOCs and Online Platforms

Major online learning platforms, including Coursera, edX, and LinkedIn Learning, occasionally offer free introductory courses in governance, risk, and compliance. These programs are designed by universities and industry experts, providing reliable, structured learning experiences without upfront costs.

Benefits:

- Flexible, self-paced study suitable for working professionals

- Access to university-level content and case studies

- Some courses provide optional paid certificates for additional recognition

3. Online GRC Webinars and Workshops

Organizations like ISC2, ISACA, and professional GRC associations frequently host free webinars, virtual workshops, and live Q&A sessions. These events provide insights into current trends, risk management practices, and compliance challenges, offering practical knowledge that complements formal certifications.

Advantages:

- Exposure to industry best practices

- Networking opportunities with certified professionals

- Updates on regulatory changes and emerging risks

Why Free and Online Options Matter

Free and online GRC resources enable aspiring professionals to:

- Gain foundational knowledge without financial barriers

- Evaluate whether a GRC career aligns with their skills and interests

- Prepare for entry-level certifications or more advanced credentials

By leveraging free courses and online learning opportunities, professionals can build the essential skills required for GRC roles while strategically planning their next steps in the certification pathway.

SEE: Cybersecurity vs Cyber Forensics: Salary, Skills & Career Paths (2026 Guide)

How to Evaluate ROI for GRC Certifications

Investing in Governance, Risk, and Compliance (GRC) certifications requires careful consideration of both costs and benefits. While the fees for exams, training, and ongoing maintenance can vary widely, the potential return on investment (ROI) often makes these credentials worthwhile for ambitious professionals and organizations seeking skilled GRC practitioners.

1. Career Advancement and Salary Growth

GRC-certified professionals often command higher salaries than their non-certified peers. Certifications like CISM, CRISC, and CGEIT signal expertise to employers, positioning holders for leadership roles such as IT risk manager, compliance officer, or audit director. According to industry data, certified professionals can earn 15–25% more than those without certifications, depending on experience and location. Certifications also open doors to promotions and strategic roles, offering long-term career mobility.

2. Job Security and Market Demand

The growing complexity of regulatory requirements, cybersecurity risks, and corporate governance expectations has created strong demand for qualified GRC professionals. By holding recognized certifications, candidates differentiate themselves in a competitive market, demonstrating their capability to manage enterprise risk and maintain compliance effectively. This demand translates to increased job stability and access to premium positions across industries.

3. Organizational Value

Employers benefit significantly from certified staff. GRC-certified professionals can implement robust compliance programs, identify risks before they escalate, and improve internal governance frameworks. This leads to fewer regulatory fines, reduced operational risks, and enhanced trust among stakeholders, including clients, investors, and regulators.

4. Cost Considerations and Financial Aid

While certification costs can range from several hundred to several thousand dollars, professionals can offset expenses through:

- Employer sponsorship programs: Full or partial reimbursement for training and exam fees.

- Financial aid and scholarships: Offered by certifying bodies and educational institutions.

- Tax deductions: In some jurisdictions, educational expenses for certification may be deductible.

5. Long-Term ROI Assessment

To evaluate ROI effectively, consider:

- Upfront costs (exam fees, study materials, training)

- Career and salary uplift over 3–5 years

- Increased employability and leadership opportunities

- Organizational impact if employed in a GRC role

By analyzing these factors, professionals can make informed decisions about which Governance Risk and Compliance GRC Certifications offer the highest value for their career objectives and financial investment.

Conclusion

Governance, Risk, and Compliance (GRC) certifications are more than credentials; they are career accelerators and strategic assets for organizations. From entry-level certifications like GRCP and CCEP to advanced credentials such as CISM, CGEIT, and CRISC, each certification equips professionals with the knowledge and skills necessary to navigate complex regulatory landscapes, mitigate risk, and strengthen corporate governance.

For individuals, these certifications offer career growth, higher earning potential, and industry recognition. For employers, hiring certified professionals enhances compliance, reduces operational and financial risks, and fosters robust governance frameworks. By evaluating certifications based on relevance, credibility, coverage, and ROI, aspiring GRC professionals can strategically select credentials that align with their career goals and organizational needs.

Whether you are just starting in governance, risk, and compliance or looking to advance into senior management, pursuing a GRC certification is a proactive step toward professional excellence. Explore the options, assess your career trajectory, and choose the certification that positions you for long-term success.

FAQ

Here are four well-crafted FAQ answers, publication-ready, and aligned with your article tone:

What is Certified in Governance, Risk, and Compliance (GRC)?

The Certified in Governance, Risk, and Compliance (GRC) credential, commonly referred to as CGRC, is a professional certification that validates an individual’s expertise in integrating governance, risk management, and compliance practices within an organization.

Holders of this certification demonstrate the ability to design, implement, and oversee frameworks that ensure regulatory compliance, mitigate enterprise risks, and align operational activities with corporate objectives. CGRC professionals often work in IT security, audit, risk management, or compliance departments, providing assurance that organizational processes meet legal and ethical standards.

How to Become a Governance, Risk, and Compliance Officer?

Becoming a GRC officer typically involves a combination of education, experience, and certifications. Key steps include:

Educational Background: A bachelor’s degree in finance, IT, cybersecurity, business administration, or a related field is recommended.

Gain Relevant Experience: Entry-level roles in audit, compliance, risk management, or IT security help build foundational skills.

Obtain Certifications: Credentials such as CCEP, CGRC, CRISC, or CISM enhance credibility and demonstrate expertise.

Develop Soft Skills: Effective communication, problem-solving, and analytical thinking are critical for coordinating between teams and management.

Network & Stay Current: Engage with professional associations, webinars, and industry forums to remain up-to-date on emerging regulations and risk trends.

Is CGRC Recognized Internationally?

Yes, the CGRC certification offered by ISC2 is recognized globally. Employers across North America, Europe, Asia, and the Middle East acknowledge it as a benchmark for GRC expertise. Its international recognition stems from its comprehensive coverage of governance frameworks, risk management strategies, and compliance standards applicable across multiple industries and regulatory environments.

Professionals holding a CGRC certification are therefore positioned for global career opportunities, whether in IT security, enterprise risk, or compliance management roles.

Is GRC in High Demand?

Absolutely. With increasing regulatory scrutiny, cybersecurity threats, and complex business operations, GRC expertise is in high demand worldwide. Organizations are actively seeking certified professionals to ensure legal compliance, mitigate risks, and strengthen governance frameworks.

Roles such as GRC analyst, compliance officer, risk manager, and IT governance consultant have seen consistent growth, often offering competitive salaries and opportunities for advancement. The demand is particularly strong in industries like finance, healthcare, technology, and government sectors, where regulatory compliance is critical.