What Is Enterprise Risk Management (ERM)? Types, Pillars, Stakeholders

What Is Enterprise Risk Management (ERM)? Types, Pillars, Stakeholders

Before asking “What is Enterprise Risk Management?” in an unpredictable business world, the first thing to understand is “Risk”. From cyberattacks that can cripple operations overnight to global supply chain disruptions and sudden regulatory shifts, organizations face threats that can derail even the best-laid plans.

Enterprise Risk Management (ERM) helps leaders see the full picture, prepare for the unexpected, and act before risks become crises.

At its core, ERM is more than a safety net. It’s a strategic framework that integrates risk awareness into every decision, ensuring that opportunities are pursued wisely and threats are addressed proactively.

Whether it’s enterprise risk management in banks dealing with credit defaults, a manufacturer securing its supply chain, or a tech firm protecting customer data, the goal is the same: resilience, sustainability, and confidence in the face of uncertainty.

This article unpacks what enterprise risk management is, how it works, real-world enterprise risk management examples, and the steps to implement a robust enterprise risk management process.

Start a Life-Changing Career in Cybersecurity Today

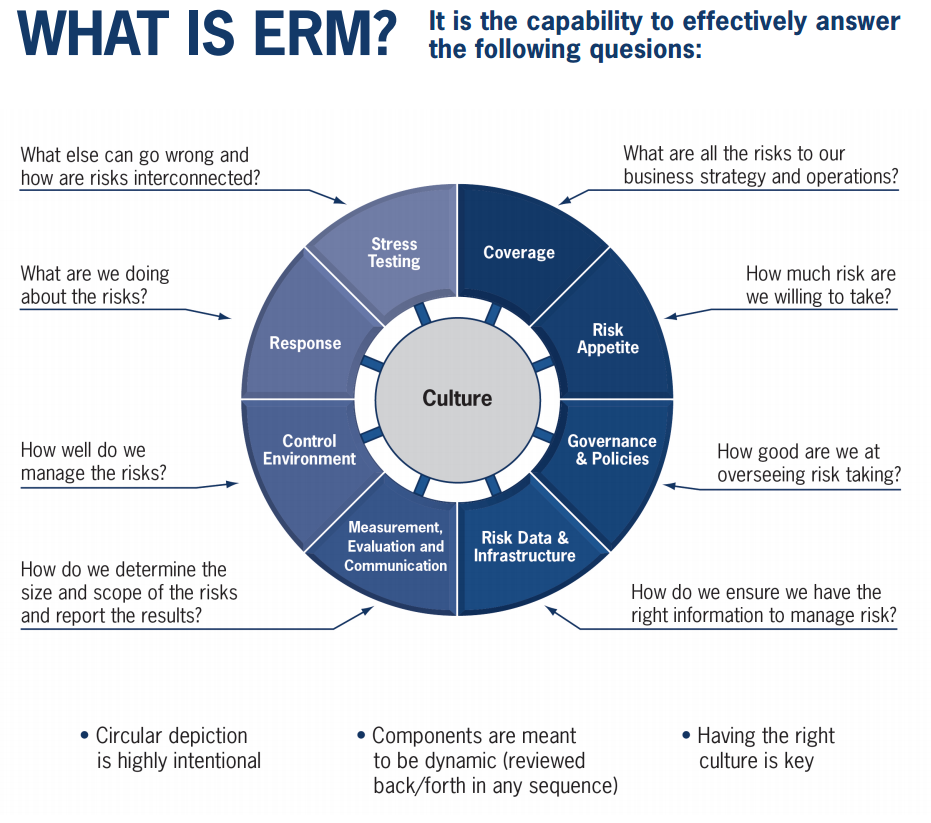

What is Enterprise Risk Management (ERM)?

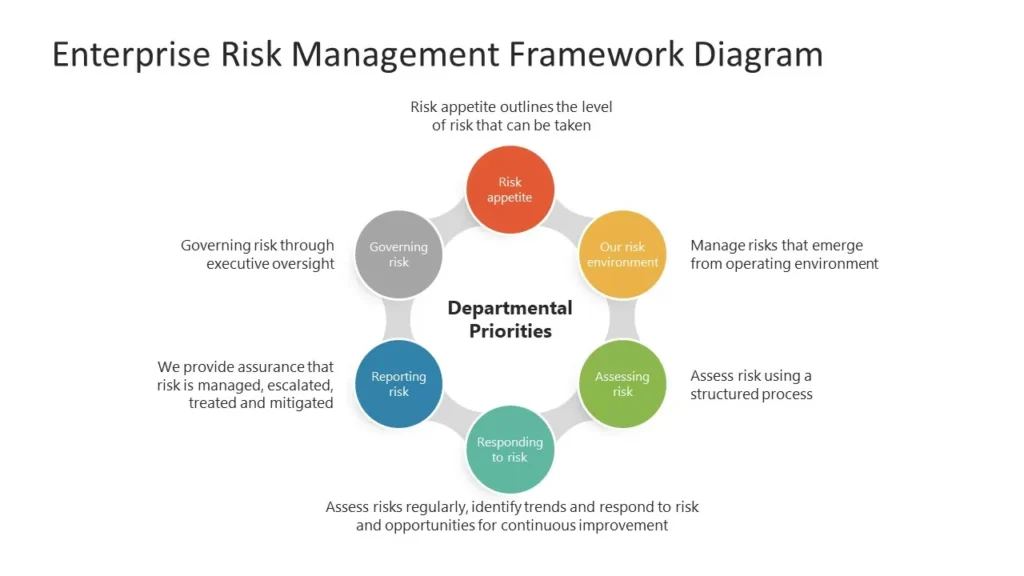

Enterprise Risk Management is a structured, organization-wide approach to identifying, assessing, managing, and monitoring risks that could impact an organization’s objectives. Unlike traditional risk management, which often focuses on individual departments or isolated issues, ERM takes a holistic view of risk. It ensures that decision-makers consider the interconnection between risks and the organization’s overall strategy, not just their immediate area of control.

A widely recognized enterprise risk management framework, such as the COSO ERM Framework or ISO 31000, provides structured guidance for implementing ERM. These frameworks emphasize governance, culture, strategy alignment, performance tracking, review processes, and effective communication. They help organizations create consistent policies, processes, and controls for managing risks across all levels.

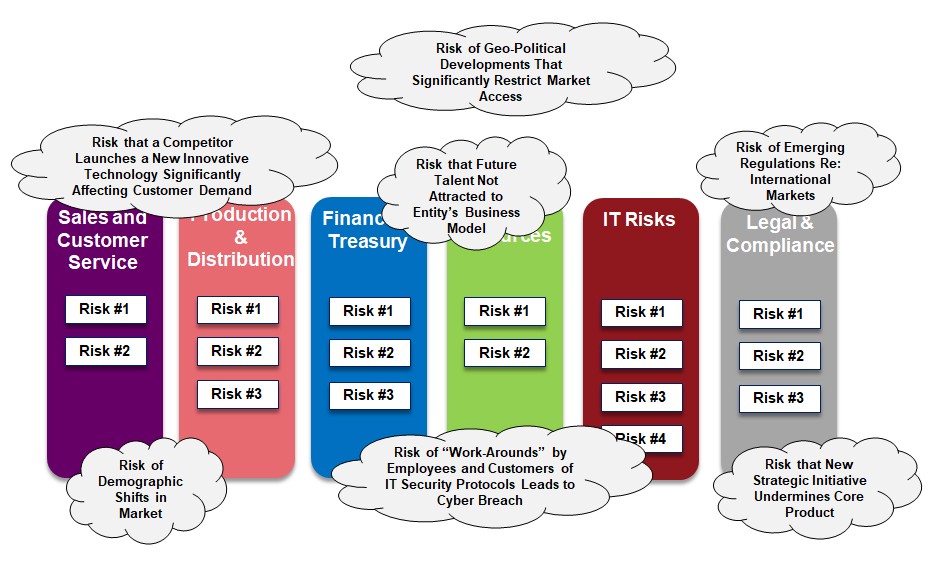

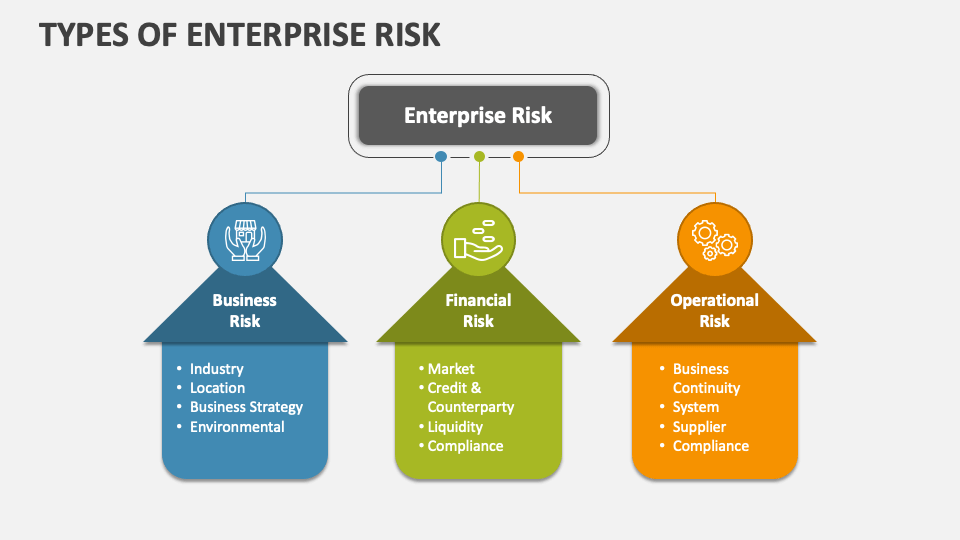

Types of Risks Addressed by ERM

ERM encompasses a wide spectrum of risk categories, including:

- Financial Risks – market volatility, credit defaults, liquidity challenges.

- Operational Risks – process failures, supply chain disruptions, technology breakdowns.

- Strategic Risks – competitive pressures, changes in consumer behavior, market entry failures.

- Compliance Risks – violations of laws, regulations, or industry standards.

- Reputational Risks – brand damage, negative publicity, ethical lapses.

- Cybersecurity Risks – data breaches, ransomware attacks, and other digital threats.

Enterprise Risk Examples can range from a bank facing large-scale loan defaults, to an airline dealing with fuel price spikes to a healthcare provider managing patient data security.

In highly regulated sectors such as finance, enterprise risk management in banks is critical. It ensures that credit risk, market risk, and operational risk are continuously monitored and mitigated. For example, banks often maintain an enterprise risk management policy that outlines governance structures, risk appetite, assessment methods, and reporting protocols to meet both regulatory expectations and internal performance goals.

In essence, ERM goes beyond avoiding losses; it enables better decision-making by understanding the balance between risk and opportunity.

RELATED: How to Become a GRC Analyst?

Why ERM is Essential in Modern Business

Today’s business environment is defined by interconnectivity, speed, and constant change. A disruption in one part of the world can send shockwaves through global markets in hours. For organizations, whether they operate in finance, manufacturing, healthcare, or technology, this means that risks are more complex, more frequent, and often more damaging than ever before.

Enterprise Risk Management is essential because it equips organizations to anticipate, prepare for, and respond to both known and emerging threats. Rather than reacting after damage occurs, ERM encourages proactive planning that safeguards operations, revenue, and reputation.

Several factors make ERM indispensable in modern business:

- Rapid Technological Change – Digital transformation introduces both opportunities and vulnerabilities, from cyberattacks to data privacy issues.

- Regulatory Complexity – Companies must navigate evolving compliance requirements, such as data protection laws, environmental regulations, and industry-specific standards.

- Global Supply Chain Risks – Disruptions due to geopolitical tensions, pandemics, or climate-related events can halt operations without warning.

- Market Volatility – Fluctuating commodity prices, currency swings, and shifting consumer preferences require agile decision-making.

- Reputation at Stake – One incident of poor crisis management can erode stakeholder trust for years.

Real-world enterprise risk management examples underscore the importance of readiness. A manufacturer with an ERM framework may diversify suppliers to reduce dependency on a single region. A global bank may deploy early-warning analytics to detect credit risk trends before they escalate. These aren’t just defensive moves; they’re strategic actions that preserve competitive advantage.

In short, ERM has shifted from being a compliance checkbox to becoming a core driver of resilience, growth, and stakeholder confidence. Organizations that embed ERM into their culture are better positioned to withstand disruption and seize opportunities when others are caught unprepared.

Core Components of an ERM Framework

A successful enterprise risk management framework provides a structured way for organizations to identify, assess, manage, and monitor risks in alignment with their strategic objectives. While there are several recognized models, the COSO ERM Framework is one of the most widely adopted globally. It breaks ERM into five interconnected components that work together to create a comprehensive risk management approach.

1. Governance and Culture

This sets the tone for how an organization approaches risk. Governance involves defining roles, responsibilities, and oversight, often led by the board of directors and senior management. Culture reflects the organization’s shared values, ethics, and risk mindset. A healthy risk culture encourages transparency, accountability, and timely reporting of potential issues.

2. Strategy and Objective-Setting

Here, the organization defines its risk appetite, how much risk it’s willing to take to achieve its goals. Business objectives are then set in line with this appetite. For example, a bank’s enterprise risk management policy may state it will not approve loans above a certain risk threshold, even if such loans could bring higher short-term profits.

3. Performance

This is where the enterprise risk management process actively operates. Risks are identified, assessed, and prioritized based on their potential impact and likelihood. Tools such as risk matrices and key risk indicators (KRIs) help in ranking risks so that resources are directed to the most critical areas first. Performance tracking ensures that risk responses, whether avoidance, reduction, transfer, or acceptance, are actually working.

4. Review and Revision

Risk management isn’t static. Regular reviews ensure that the ERM framework adapts to new threats, regulatory changes, and business shifts. For instance, a manufacturing firm may revise its ERM strategy after experiencing a major supply chain disruption to better address similar risks in the future.

5. Information, Communication, and Reporting

Timely and accurate information flow is essential for informed decision-making. This involves gathering relevant internal and external data, sharing it with stakeholders, and using reporting tools—such as dashboards—to visualize the organization’s risk profile. Effective communication ensures that everyone, from executives to front-line staff, understands their role in managing risk.

These components, when implemented effectively, transform ERM from a compliance exercise into a strategic advantage, ensuring risks are managed in a way that supports growth and long-term sustainability.

MORE READ: Cybersecurity vs Cloud Computing: A Comprehensive Comparison

The ERM Process: Step-by-Step

Implementing a solid enterprise risk management process means following a structured, repeatable sequence that ensures risks are not just identified, but effectively managed and monitored. While every organization adapts this to its own operations, the general process follows four key steps.

Step 1: Identify Risks

This is the foundation of ERM. It involves spotting both internal and external risks that could affect the organization’s objectives.

- Internal risks include process inefficiencies, human error, or system failures.

- External risks include market downturns, regulatory changes, geopolitical events, or natural disasters.

Techniques for Risk Identification:

- SWOT Analysis – Assess strengths, weaknesses, opportunities, and threats.

- Scenario Analysis – Explore “what if” situations.

- Risk Registers – Maintain a formal list of identified risks.

- FMEA (Failure Mode and Effects Analysis) – Identify points where a process could fail and their consequences.

Enterprise risk examples: A bank may list credit defaults as a key financial risk, while a hospital may list patient data breaches as a major operational risk.

Step 2: Assess Risks

Once risks are identified, the next step is to determine their potential impact and likelihood.

- Quantitative methods: Use data, models, and financial metrics to assign numerical values to risks.

- Qualitative methods: Use expert judgment, interviews, and ranking systems for non-financial risks.

A risk matrix is often used to classify risks as high, medium, or low priority, helping organizations focus on what matters most.

Step 3: Mitigate and Control Risks

Risk mitigation involves reducing the likelihood or severity of risks, while control means putting safeguards in place for ongoing management. Common strategies include:

- Avoidance – Eliminate the activity that causes the risk.

- Reduction – Implement measures to minimize risk impact.

- Transfer – Shift the risk to another party (e.g., insurance).

- Acceptance – Acknowledge the risk and prepare contingency plans.

Example: In enterprise risk management in banks, credit risk can be mitigated through stricter loan approval policies and diversified lending portfolios.

Step 4: Monitor and Report

Risks are dynamic, so continuous monitoring is essential. This includes:

- Tracking Key Risk Indicators (KRIs).

- Using dashboards for real-time visibility.

- Regular reporting to executives, boards, and regulators.

An enterprise risk management policy usually defines how often risk reports are produced and who receives them. In sectors like finance, this reporting can be monthly or even daily for critical risks.

ALSO: HR vs Cybersecurity: Which Career Path Offers More Opportunity in 2025?

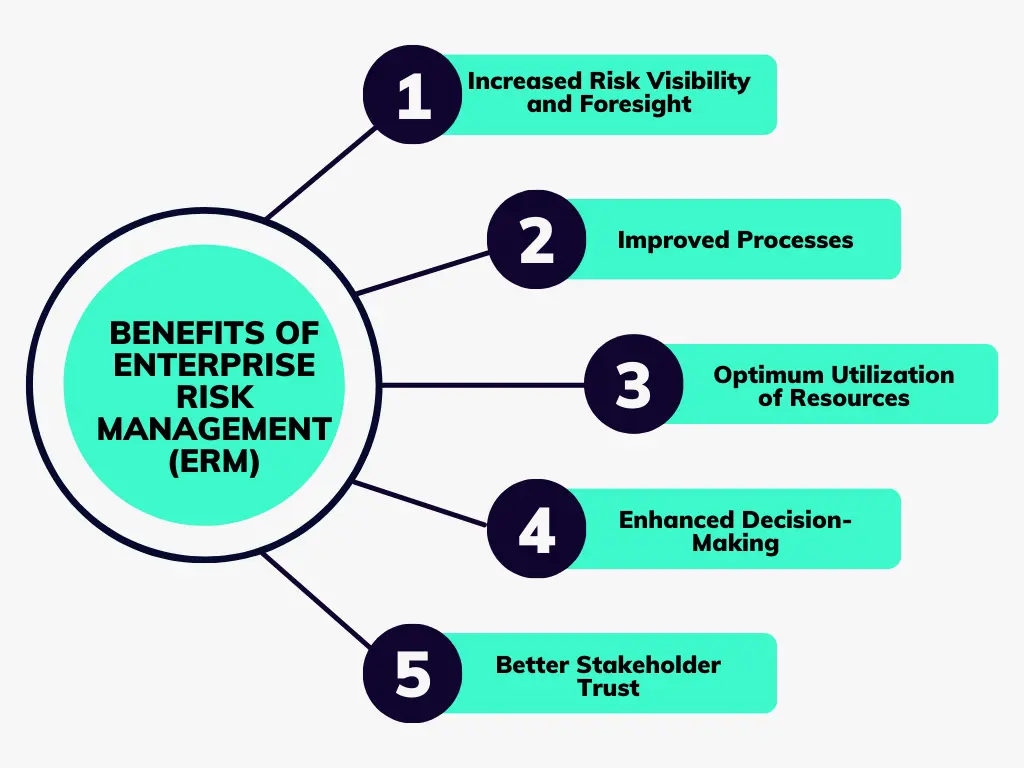

Benefits of Implementing ERM

A well-structured enterprise risk management framework doesn’t just prevent losses, it actively strengthens an organization’s decision-making, efficiency, and reputation. By integrating risk thinking into every level of operations, ERM delivers advantages that go far beyond compliance.

1. Improved Decision-Making

With a clear understanding of potential threats and opportunities, leaders can make informed choices. For example, in enterprise risk management in banks, early detection of credit risk trends allows executives to adjust lending strategies before defaults spike. ERM provides a “big picture” view, ensuring decisions are aligned with both short-term needs and long-term goals.

2. Early Threat Detection

By continuously monitoring the risk landscape, ERM identifies warning signs before they escalate into crises. This is critical in industries like energy, healthcare, and aviation, where even small risks can have catastrophic consequences.

3. Operational Efficiency and Cost Savings

A strong enterprise risk management policy ensures that resources are allocated to the most critical areas. Eliminating redundant processes, preventing downtime, and streamlining compliance can lead to significant cost reductions.

4. Regulatory Compliance and Legal Protection

ERM helps organizations stay ahead of changing regulations, reducing the likelihood of fines, penalties, or lawsuits. In highly regulated sectors, compliance is not optional; it’s a survival requirement. Documented ERM practices also serve as legal protection, demonstrating due diligence in risk management.

5. Enhanced Stakeholder Confidence

Investors, customers, employees, and regulators are more likely to trust organizations that actively manage risks. Transparency through regular reporting builds credibility and strengthens relationships.

Enterprise risk management examples prove these benefits in action. A global manufacturer using ERM might avoid production delays by diversifying suppliers. A hospital might prevent reputational damage by proactively securing patient data. These proactive moves translate directly into business resilience and competitive advantage.

SEE: Accounting vs Cybersecurity: Everything You Need to Know

Challenges & Best Practices in ERM Implementation

While the benefits of enterprise risk management are clear, putting it into practice is not without obstacles. Organizations often encounter cultural resistance, technical complexities, and resource constraints. Addressing these challenges with proven best practices is the key to making ERM sustainable and effective.

Common Challenges

1. Resistance to Change

Employees and managers accustomed to siloed decision-making may resist a cross-functional risk approach. This resistance can delay or dilute ERM adoption.

2. Lack of Leadership Buy-In

Without strong support from executives and the board, ERM initiatives may lack the authority and resources they need.

3. Integration Complexity

Embedding an enterprise risk management framework into existing processes, especially in large, decentralized organizations, can be challenging. Legacy systems may not easily integrate with modern ERM tools.

4. Data Quality and Accessibility

Incomplete, inconsistent, or siloed data can undermine risk analysis and lead to poor decisions.

5. Skills Gaps

Not all employees have the training or experience to recognize and manage risks effectively, especially in industries with complex compliance requirements.

Best Practices

1. Engage Stakeholders Early

Involve employees across all levels in designing the enterprise risk management process. This encourages buy-in and ensures that risk identification is thorough.

2. Secure Leadership Commitment

Highlight the strategic value of ERM, improved resilience, cost savings, and competitive advantage, to gain executive sponsorship.

3. Start with Pilot Programs

Before rolling out ERM across the organization, test it in a single department or project to refine processes and demonstrate value.

4. Establish Strong Data Governance

Implement policies for consistent data collection, storage, and sharing. Use analytics tools to turn raw data into actionable insights.

5. Provide Ongoing Training

Regular workshops, certifications, and simulations help build a risk-aware culture and close skill gaps.

6. Foster Collaboration

Cross-functional risk committees encourage open communication and knowledge sharing between departments.

7. Review and Adapt

Risk environments change constantly. Periodic reviews ensure your enterprise risk management policy stays relevant and effective.

READ: What Coding Language is Best for Cybersecurity?

Case Studies of ERM in Action

Real-world enterprise risk management examples show how organizations across industries apply ERM to anticipate threats, protect assets, and maintain stability. These cases illustrate how a structured enterprise risk management process translates into measurable results.

1. Airbus SE – Managing Global Supply and Regulatory Risks

As a leading aerospace manufacturer, Airbus faces risks ranging from complex supply chain dependencies to strict international regulations.

- Risk Identification: Uses internal assessments, scenario planning, and market research to uncover potential threats.

- Risk Assessment: Combines quantitative modeling with qualitative input from cross-functional teams.

- Mitigation: Diversifies suppliers, maintains redundant production capabilities, and develops contingency plans for critical components.

- Monitoring: Tracks key risk indicators through a central dashboard reviewed by executives and the board.

This proactive approach has helped Airbus minimize disruptions during global events like Brexit and pandemic-related lockdowns.

2. Procter & Gamble – Safeguarding Brand Reputation and Operations

For consumer goods giant P&G, reputational risk is as critical as operational risk.

- Risk Identification: Monitors global social media, consumer feedback, and market reports for early warning signs.

- Assessment & Control: Implements strict quality assurance procedures and supplier audits.

- Mitigation: Invests in supply chain resilience, cybersecurity protections, and brand protection strategies.

By integrating ERM into brand management, P&G has successfully navigated product recalls and maintained consumer trust.

3. General Electric – Multi-Sector Risk Coordination

Operating in aviation, energy, healthcare, and manufacturing, GE faces diverse risks.

- Risk Identification: Conducts enterprise-wide, business-unit, and project-level assessments.

- Assessment: Uses sophisticated analytics to model financial and operational risk scenarios.

- Mitigation: Diversifies its investment portfolio, hedges currency exposures, and invests in crisis response capabilities.

GE’s structured enterprise risk management framework ensures consistent practices across its varied business units, improving both resilience and decision-making.

These enterprise risk management examples demonstrate a common theme: ERM is more than a compliance function; it’s a strategic enabler that supports long-term sustainability, protects reputation, and strengthens competitive advantage.

MORE: GRC Analyst vs SOC Analyst: Everything You Need To Know

ERM vs Related Systems

While enterprise risk management focuses on identifying, assessing, and managing risks across an entire organization, other systems like ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management) serve different but complementary purposes. Understanding the distinctions helps organizations integrate these systems effectively.

ERM vs ERP

- ERM: Concerned with risk, strategic, financial, operational, compliance, and reputational. The goal is to protect value, ensure sustainability, and guide decision-making.

- ERP: Focused on optimizing and integrating core business processes such as finance, manufacturing, inventory, HR, and sales. The goal is operational efficiency and productivity.

Example: An ERP system might highlight growth opportunities in a new market. An ERM framework might flag that same market as having high political or regulatory risk, prompting a more cautious entry strategy.

ERM vs CRM

- ERM: Inward-focused, monitoring risks that affect the organization’s operations, assets, and strategy.

- CRM: Outward-focused, managing interactions with customers and prospects to increase sales, improve service, and build loyalty.

Example: A CRM system may help a retailer track customer purchase trends. An ERM process could assess the risk of relying too heavily on one supplier for a popular product, ensuring customer demand can be met consistently.

While these systems serve distinct purposes, they are most powerful when aligned. Integrating ERM insights into ERP and CRM workflows ensures that strategic decisions consider both opportunities and potential threats, leading to better-balanced outcomes.

Getting Started with ERM in Your Organization

Launching an enterprise risk management framework doesn’t require overhauling your entire operation from day one. The key is to start small, build momentum, and scale strategically. Here’s a step-by-step guide to initiating the enterprise risk management process in a practical, sustainable way.

1. Assess Your Current Risk Culture

Before creating policies or tools, understand how your organization currently views and handles risk. Is risk management reactive or proactive? Are risks discussed openly across departments? This baseline assessment will guide your ERM strategy.

2. Define Risk Appetite and Objectives

Establish how much risk your organization is willing to take in pursuit of its goals. For instance, in enterprise risk management in banks, credit risk appetite might be defined in terms of acceptable default rates. Align this with your strategic objectives so every decision reflects the right balance between risk and reward.

3. Select or Customize a Framework

Choose a recognized enterprise risk management framework like COSO ERM or ISO 31000, and tailor it to your industry and organizational needs. This ensures consistency in processes, language, and expectations.

4. Build a Cross-Functional Risk Team

Include representatives from key departments, finance, operations, IT, compliance, HR, and more. This diversity ensures risks are identified from every angle and that mitigation strategies are realistic.

5. Start Small, Then Scale

Pilot your ERM program in one department or project before expanding. This allows you to refine processes, prove value, and build internal support.

6. Formalize with a Policy

Document an enterprise risk management policy outlining roles, responsibilities, reporting structures, assessment methods, and review cycles. This makes ERM an official, enforceable part of your operations.

7. Monitor, Measure, and Improve

Track your progress using KPIs and Key Risk Indicators (KRIs). Conduct regular reviews to adjust the framework as new risks emerge or business priorities shift.

Starting ERM is less about building a perfect system overnight and more about embedding a culture of risk awareness that grows stronger over time.

Final Thoughts…

In a business environment where uncertainty is the only constant, enterprise risk management has become a strategic necessity rather than a regulatory afterthought. A well-implemented enterprise risk management framework enables organizations to identify threats early, respond proactively, and align every decision with long-term objectives.

Whether it’s a global bank enforcing its enterprise risk management policy to maintain credit stability, a manufacturer diversifying suppliers to reduce operational risk, or a tech firm strengthening cybersecurity defenses, the principles remain the same: anticipate, prepare, and adapt.

By following a structured enterprise risk management process, embedding a risk-aware culture, and staying attuned to emerging trends like AI-driven analytics, ESG integration, and cyber resilience, organizations can move beyond simply avoiding loss. They can position themselves to seize opportunities with confidence, even in volatile markets.

FAQ

What are the 5 components of ERM?

According to the COSO Enterprise Risk Management Framework, the five components are:

Governance and Culture – Establishes oversight responsibilities and promotes a risk-aware culture.

Strategy and Objective-Setting – Aligns risk appetite with strategic goals.

Performance – Identifies, assesses, and responds to risks while monitoring progress.

Review and Revision – Evaluates and improves ERM practices over time.

Information, Communication, and Reporting – Ensures timely sharing of relevant risk information with stakeholders.

What are the 4 pillars of ERM?

While different organizations may define them slightly differently, the common four pillars of enterprise risk management are:

Risk Identification – Spotting internal and external risks that could impact objectives.

Risk Assessment – Measuring the likelihood and potential impact of identified risks.

Risk Response – Developing strategies to mitigate, transfer, accept, or avoid risks.

Risk Monitoring and Reporting – Tracking risks over time and updating stakeholders.

What are three risks of enterprise?

Common enterprise risk examples include:

Financial Risk – Market volatility, credit defaults, liquidity challenges.

Operational Risk – Supply chain disruptions, technology failures, or human error.

Reputational Risk – Brand damage from negative publicity, ethical lapses, or customer dissatisfaction.

Who are the key stakeholders in ERM?

Key stakeholders in the enterprise risk management process typically include:

Board of Directors – Sets the tone and oversees ERM strategy.

Executive Management – Implements ERM policies and ensures alignment with objectives.

Risk Managers / Chief Risk Officer (CRO) – Lead the identification, assessment, and mitigation of risks.

Department Heads – Manage risks specific to their functions.

Employees – Play a role in identifying and reporting risks in day-to-day operations.

Regulators and External Auditors – Ensure compliance with industry and legal requirements.

What is ISO 31000?

ISO 31000 is an international standard for risk management, developed by the International Organization for Standardization (ISO). It provides guidelines and principles for implementing a robust risk management framework, applicable to any organization regardless of size, industry, or sector.

Unlike prescriptive standards, ISO 31000 focuses on integrating risk management into decision-making, culture, and organizational processes.